us exit tax percentage

Your average net income tax liability from the past five years is over. Citizens or Legal Permanent Residents who qualify as an LTR Long-Term Residents.

2020 Presidential Election Exit Polls Share Of Votes By Income U S 2020 Statista

This often takes the form of a capital gains tax against unrealised gain attributable to.

. The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before. Legal Permanent Residents is complex. An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country.

6 NovemberDecember 2020 Pg 60 Gary Forster and J. Citizens who have renounced their. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax.

Green Card Exit Tax 8 Years Tax Implications at Surrender. What is expatriation tax. The covered expatriate rules apply to US.

Green Card Exit Tax 8 Years. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. What is US exit tax.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market. Exit taxes can be imposed on individuals who relocate. Expatriation from the United States.

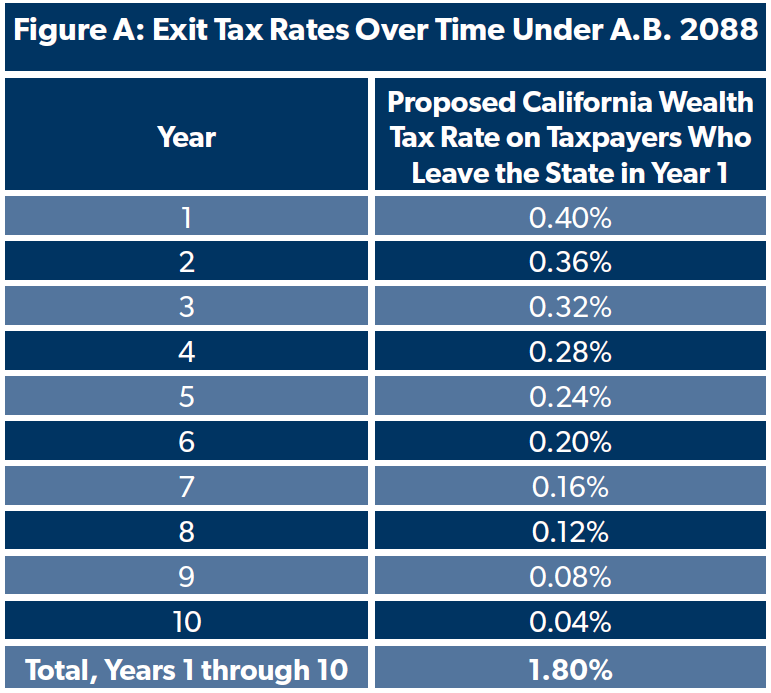

The IRS Green Card Exit Tax 8 Years rules involving US. Is AB 2088 a California Exit Tax. Funds TSA at 560 per one-way up to 1120 per round trip was 250 per enplanement up to 500 per one-way trip from 2102 through 72014.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. In 2008 the first US exit tax was introduced under the Heroes Earnings Assistance and Relief Tax HEART Act signed into law by President Bush. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up.

US Treasury Bonds Rates. The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years. Persons who were either US.

Which tax rate applies to your 2022 long-term capital gains will depend on your taxable income. At the time of writing the current maximum. The US exit tax.

Exit Tax Us After Renouncing Citizenship Americans Overseas

What Are The Us Exit Tax Requirements New 2022

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Green Card Exit Tax Abandonment After 8 Years

Us Investors Continued To Exit Equity Mutual Funds In 2012 December 26th 2012 Mutuals Funds Equity Investors

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Renounce U S Here S How Irs Computes Exit Tax

Us Exit Taxes The Price Of Renouncing Your Citizenship

This Is The Best Illustration Of History S Bull And Bear Markets We Ve Seen Yet Bear Market Stock Market Chart

Green Card Holder Exit Tax 8 Year Abandonment Rule New

What Type Of Startup Founder Are You Start Up Investing What Type

What Are The Us Exit Tax Requirements New 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas