montana sales tax rate 2019

Tax rate of 4 on taxable income between 8201 and 11100. 5400 2 of taxable income.

How Is Tax Liability Calculated Common Tax Questions Answered

For earnings between 310000 and 540000 youll pay 2 plus 3100.

. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Montana does not have a state sales tax and does not levy local sales taxes. Montana Constitution as amended in 1972 provides for up to a 4 sales tax.

Montana has a 675 percent corporate income tax rate. Find your income exemptions. Tax rate of 3 on taxable income between 5401 and 8200.

The chart below breaks down the Montana tax brackets using this model. Check the 2019 Montana state tax rate and the rules to calculate state income tax. The bill opens the door with a 25 tax that will go into effect on January 1 2020.

The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a lodging facility use tax and a limited sales and use tax on the base rental charge for rental vehicles. There are no local taxes beyond the state rate.

8 acres 2200000. Nationwide Montana ranks 33rd for its effective residential property tax rate of 073 percent. The Montana Department of Revenue is responsible for publishing the.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. Call Avalara Sales Tax Augustus McCrae Lonesome Dove Whitefish Montana Local sales tax Montana Department of Revenue Montana Bozeman Montana Larry McMurtry sales and use tax Resort Tax winter recreation sports. Where Property Taxes Come From Millions of Dollars 995 313.

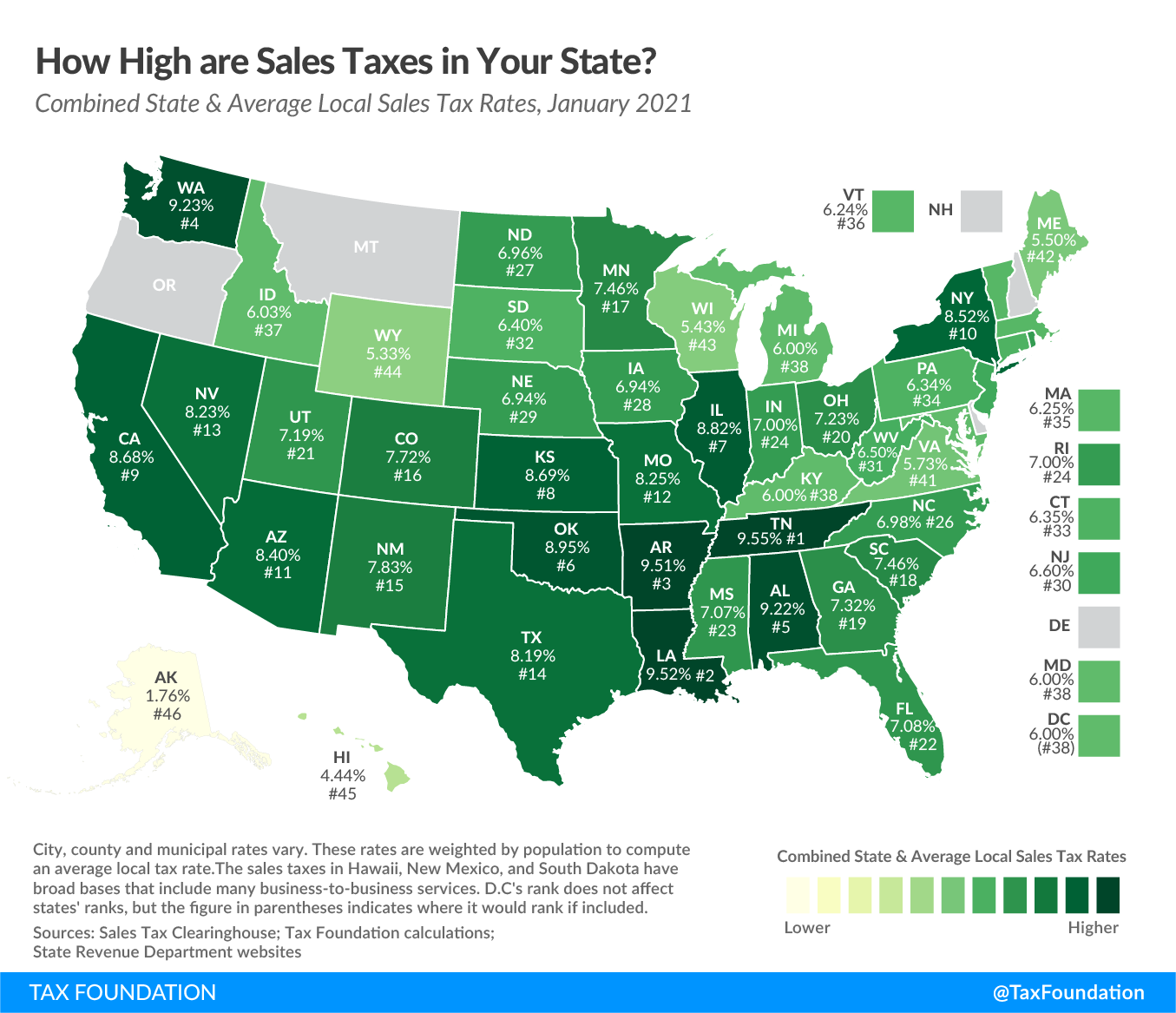

Different counties have different tax rates. For earnings between 540000 and 820000 youll pay 3 plus 7700. The state sales tax rate in Montana is 0000.

But not more than Then your tax rate is. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets. Whitefish Lake Resort Grizzly bears Big Sky Country AvaTax Woodrow F.

By William Murphy Senior Editor. Montana needs to fully overhaul the tax structure and if that involves a sales tax higher income tax a summer tourist tax or legalizing marijuana so be it. If your taxable income Form 2 page 1 line 14 is.

2022 Montana Sales Tax Table. Find your gross income. The state sales tax rate in Montana is 0 but you can.

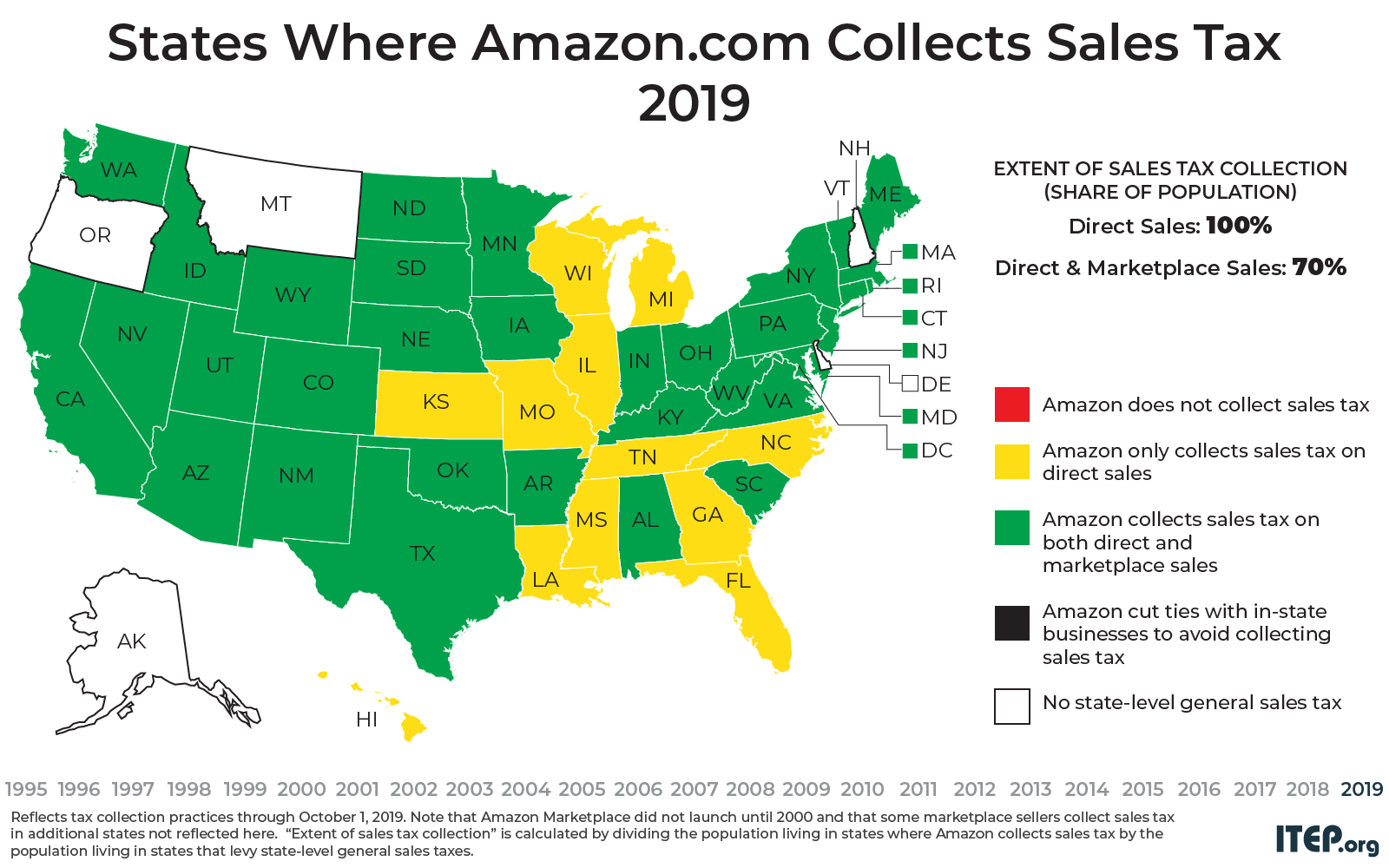

There is no state sales tax in Montana. File Single Head of Household or Married Filing Jointly Claim a standard deduction Are a Full-Time Montanan Only report income from Forms W-2 1099-INT or 1099-DIV Are not claiming any credits except the Montana Elderly HomeownerRenter Credit. Effective tax rates are property taxes divid- ed by the market value of the property.

8200 3 of taxable income. You may qualify for MT QuickFile if you. By Justin Fontaine July 26 2019.

Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. Tax rate of 2 on taxable income between 3101 and 5400. 368 rows There are a total of 73 local tax jurisdictions across the state collecting an average.

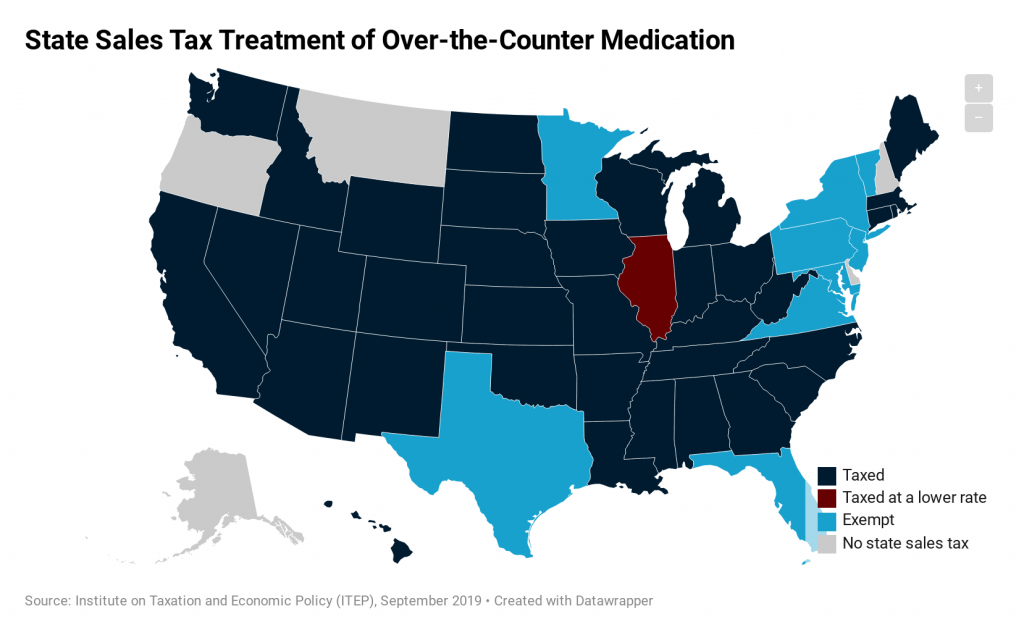

Montana local resort areas and communities are authorized. The cities and counties in Montana also do not charge sales tax on general purchases so the state enjoys tax free shopping. 2019 Sales Taxes Montana has no general sales tax but levies selective excise taxes on gasoline alcohol tobacco lodgings and other items.

Base state sales tax rate 0. Montana charges no sales tax on purchases made in the state. Find your pretax deductions including 401K flexible account contributions.

Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. Montana Individual Income Tax. In effect that lowers the top capital gains tax rate in Montana from 69 to 49.

2019 Montana Individual Income Tax Rates. MT QuickFile is for filing a Montana State Tax Return. 3100 1 of taxable income.

For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. 11100 4 of taxable income. Montana does not impose a state-wide sales tax.

For married taxpayers living and working in the state of Montana. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis. Montana ranks relatively high on its use of.

In reviewing the history of a sales tax in other states the rate has continually been adjusted upward as infrastructure costs increase. Elect Utility Telecomm All Other. The Montana State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Montana State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Table 2Effective Property Tax RatesResidential Property. Montanas tax system ranks 5th overall on our 2022 State Business Tax Climate Index. For earnings between 000 and 310000 youll pay 1.

Some locations Montana such as Whitefish charge tax on lodging. 2 - Caps property taxes rates on residences at 1 and limits annual increases in assessed valuations to 2 or the inflation rate whichever is lower. Tax rate of 69 on taxable income over 18400.

The credit is equal to 2 of all net capital gains listed on your Montana income tax return. How to Calculate 2019 Montana State Income Tax by Using State Income Tax Table. Tax rate of 1 on the first 3100 of taxable income.

Married Filing Jointly Tax Brackets. Get a quick rate range. Montana state sales tax rate.

North Carolina Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

States Without Sales Tax Article

Sales Tax Definition What Is A Sales Tax Tax Edu

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Tax On Grocery Items Taxjar

How Is Tax Liability Calculated Common Tax Questions Answered

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

Montana State Taxes Tax Types In Montana Income Property Corporate